NY LS 59 2015-2026 free printable template

Show details

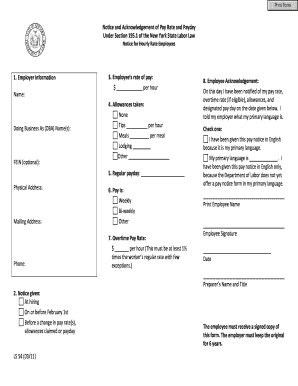

Notice and Acknowledgement of Pay Rate and Payday Under Section 195.1 of the New York State Labor Law Notice for Exempt Employees 1. Employer Information Name: Doing Business As (DBA) Name(s): VEIN

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ls59 form

Edit your ls 59 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ls59 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing wage acknowledgement form online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form ls 59. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY LS 59 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out pdffiller form

How to fill out NY LS 59

01

Obtain the NY LS 59 form from the appropriate state website or office.

02

Fill in your name and contact information at the top of the form.

03

Indicate the type of certification you are requesting.

04

Provide any required identification or reference numbers.

05

Fill out the section regarding the details of the request.

06

Attach any necessary documentation that supports your request.

07

Review the form for accuracy and completeness.

08

Sign and date the form at the bottom.

09

Submit the form to the designated office either in person or via mail.

Who needs NY LS 59?

01

Individuals seeking certification for a specific legal matter in New York.

02

Attorneys requiring verification of an individual's legal status.

03

Businesses needing to confirm compliance with legal regulations.

04

Anyone involved in a legal process that necessitates documentation.

Fill

notice ls 59

: Try Risk Free

People Also Ask about form 59

What qualifies an exempt employee in NY?

Employees who are exempt from the FLSA's minimum wage and overtime laws include: executive, administrative, and professional employees and some computer workers; outside salespeople such as those who do sales away from the employer's place of business, like a door-to-door salesperson.

How many hours can a salaried exempt employee be forced to work in New York?

Work any number of hours each week: Employers are not restricted to a 40-hour work week. This means that your employer has the authority to require you to work more than 40 hours in a given calendar week. Of course, overtime laws apply to any hours over 40 worked in a calendar week.

What are the salary exempt requirements in New York State?

The salary threshold for exempt executive and administrative employees working in New York City, Westchester County and Long Island remains $1,125.00 per week.

What is the 7 minute rule in New York State?

When a New York City employer rounds up or down in 15-minute increments, the employer must cut off rounding down at 7 minutes. For example, if the employee works between 8 to 15 minutes, the employer must round the employee's time up to the next fifteen minutes.

What makes an employee exempt in NYS?

Employees who are exempt from the FLSA's minimum wage and overtime laws include: executive, administrative, and professional employees and some computer workers; outside salespeople such as those who do sales away from the employer's place of business, like a door-to-door salesperson.

What is the salary requirement for exempt employees in NYS?

Minimum Wage and Salary Exemption Threshold Increases In 2023, the minimum salary threshold for the executive and administrative exemption for every part of New York state except New York City, Long Island and Westchester County will increase from $990 a week to $1,064.25 a week.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute ny ls 59 online?

With pdfFiller, you may easily complete and sign fillable ls 59 online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit people also ask about ls59 an employee exempt in nys on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign nys ls 59 form on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Can I edit form59 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute nys wage form from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is NY LS 59?

NY LS 59 is a form used for reporting certain transactions and tax information in New York State.

Who is required to file NY LS 59?

Individuals or businesses that engage in specific tax-related activities, as outlined by the New York State Department of Taxation and Finance, are required to file NY LS 59.

How to fill out NY LS 59?

To fill out NY LS 59, you need to provide accurate information as requested on the form, including personal or business details, transaction data, and tax calculations, following the guidelines provided by the New York State authorities.

What is the purpose of NY LS 59?

The purpose of NY LS 59 is to ensure proper reporting of tax obligations and compliance with New York State tax laws.

What information must be reported on NY LS 59?

NY LS 59 requires reporting of personal or business identification, transaction amounts, applicable taxes, and any other relevant financial information as stated in the form requirements.

Fill out your NY LS 59 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New York State Wage Form is not the form you're looking for?Search for another form here.

Keywords relevant to 59 form

Related to ls form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.